Can container shipping reinvent for the digital age?

In 1967, the British Transport Docks Board (BTDB) commissioned McKinsey & Company to assess the impact of a recent development from the United States: container boxes. The first purpose built ships for them were being launched, and a few US lines were carrying these novelties on their regular service.

McKinsey & Company predicted:

Containerised cargo is effectively becoming homogenous, like other bulk cargoes, and is subject to the same economies of scale. Economics of scale will result in this concentrated cargo being handled by a small number of large organisations. Efficient use of expensive containers will require extensive route networks under unified control to allow load balancing.”

Now that standardised containers have been introduced in the shipping industry, the rush to ‘get on the bandwagon’ will probably lead to substantial overexpansion.

If container ships follow the tanker trend, ships of more than 10,000-container capacity could be available.

Feeder services will tend to replace direct calls when the large container ships come into service.

Rotterdam is an example of a European port which is in a good position to fill a major transoceanic role.

The role of British ports may tend to become that of feeders to the Continent.... Proximity of British East Coast ports to Europe will dictate their use.

In their October 2017 report they posed the question: In 1967, containers were disrupting the shipping business, so the players had to rethink everything. Now it’s digital, big data, and the Internet of Things. Is it time to rethink everything again?

In 1956, the first ship to transport containers, named the Ideal X, carried only 58 of them. Since then, container-ship capacity has grown 370-fold: today’s largest vessels can hold more than 20,000 TEUs. Larger vessels provide greater cost efficiencies in fuel and crews, reduce greenhouse-gas emissions per container, and enable hub-and-spoke network strategies. Moreover, as operators collaborate in alliances, putting a single large vessel instead of two small ones on a given route has its advantages.

So, how much longer will this trend toward growth in capacity continue? In the long term, three factors could limit it.

The first is that returns to scale decline with increasing size, so a move from 20,000 to 40,000 TEUs wouldn’t reduce unit costs as much as a move from 10,000 to 20,000 TEUs.

Second, the narrowness and shallowness of some of the world’s waterways impose physical constraints: for example, the Strait of Malacca (between the Malay Peninsula and the Indonesian island of Sumatra) has a minimum depth of 25 meters, the most modern channels of the Suez Canal a depth of 24 meters. The latest designs for vessels that carry 24,000 TEUs have a depth of 16 meters, which leaves scope for further growth in capacity.

Third, over the past decade, the blitz for bigger vessels has strained terminal and port operators, forcing them to invest in new cranes, dredging equipment, reinforced quay walls, and extended berths. Unloading containers from bigger ships takes longer because cranes must reach farther across vessels, thus extending berth occupancy and reducing productivity.

On balance, we do not view 20,000 TEUs as the natural end point for container ships—50,000-TEU ones are not unthinkable in the next half-century. However, progress will probably be much slower than it was in the past decade: overcapacity means that new ordering will be slower over the next five to ten years. Lower slot costs materialise only when demand fills up larger ships, which hasn’t happened recently. But if demand catches up with supply, as it may well do in the early 2020s, the logic of scale will once again drive orders for bigger and bigger ships. Nonetheless, since 40 percent of all shipyard capacity is unutilised, and it’s not conceivable that governments will allow shipyard bankruptcies on a large scale, they could find a way to prompt some level of new ordering.

The size of boxes could also increase. From the original six-foot-long Conex box the US military used in the 1950s, they have grown to 20 and now 40 feet and above. The limitation on box size is compatibility with road, rail, and other modes of transport. On US and Chinese roads, the maximum box length is 53 feet, so containers of this size are common for US domestic trade. As road networks improve and trucking becomes autonomous on major routes, we may well see containers 60 or more feet long, as well as wider and taller containers.

Wholly automated terminal and inland operations, with self-driving trucks (and perhaps even self- driving containers or “hyperloops”) transporting containers to inland distribution centres, will probably become the norm in the next couple of decades. Self-loading trucks, arriving just in time to pick up the next container without waiting or moving around unproductively at terminals, would improve the interface between ports and inland transport. Imagine a terminal with no stacks in the yard; instead, customs would pre-clear boxes digitally, and autonomous trucks would take them straight from ships and out to customers.

Advances in the use of data and analytics will bring further step changes in productivity. Shipping companies could heed the example of today’s state- of-the-art aircraft, which generate up to a terabyte of data per flight. Coupled with the introduction of more sensors, the better usage of the data that ships and containers generate would allow enhancements such as optimising voyages in real time (by taking into account weather, currents, traffic, and other external factors), smarter stowage and terminal operations, and predictive maintenance. Data could also improve the coordination of arrivals at port—a major benefit, since 48 per- cent of container ships arrive more than 12 hours behind schedule, thus wasting the carriers’ fuel and underutilising the terminal operators’ labor and quay space.

Data can create additional value for customers too. Full transparency on shipments, from one end of the value chain to the other, would be an enormous boon to carriers, forwarders, and shippers alike, giving them access to real-time information and enabling them to predict a container’s availability, arrival times, and so forth. Some ports (such as Antwerp, Hamburg, and Singapore) are already starting to share information in real time across data ecosystems, which could eventually extend throughout the whole industry. That would create a truly integrated end-to-end flow of containers and therefore make the industry more productive by reducing handovers, waiting times, and unnecessary handling.

A data-enabled shipping industry could also support its customers’ supply chains in important ways— but that will require a truly new order of performance and efficiency. The real-time visibility of all container movements, reliable forecasts, and integrated flow management will pave the way for flexible, dynamic supply chains that all but eliminate waiting times and inefficiencies. This achievement will be especially beneficial for industries (such as automotive) that have increasingly complex supply chains or for those with special needs (suchas cold chains). It will also allow smart logistics providers to differentiate themselves and earn premiums. But these opportunities won’t appeal to all customers; other sectors will demand only basic logistics services at the lowest possible cost.

By 2067, we believe shipping will have some or all of these characteristics:

Autonomous 50,000-TEU ships will plow the seas—perhaps alongside modular, dronelike floating containers—in a world where the volume of container trade is anything from two to five times greater than it is today.

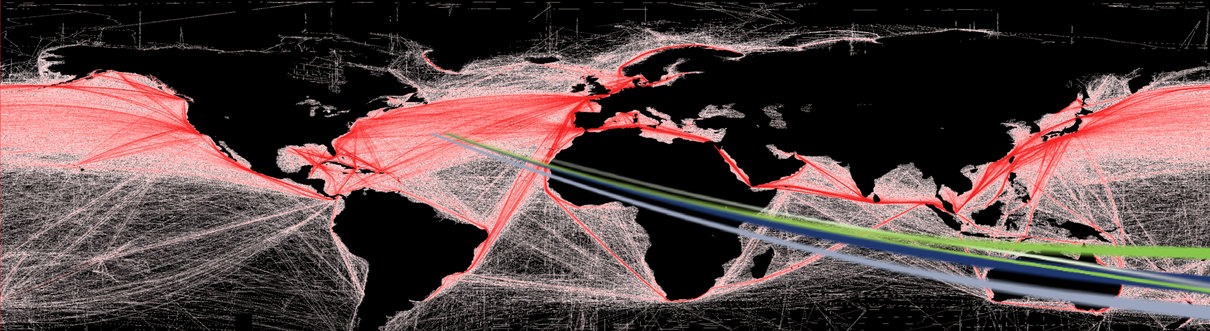

Short-haul intraregional traffic will increase as manufacturing footprints disperse more widely because of converging global incomes and the increasing use of automation and robotics. Container flows within the Far East will continue to be huge, and the secondmost significant trade lane may link that region to Africa, with a stopover in South Asia.

After multiple value-destroying cycles of overcapacity and consolidation, three or four major container-shipping companies might emerge. These businesses could be either digitally enabled independents with a strong customer orientation and innovative commercial practices or small subsidiaries of tech giants seamlessly blending the digital and physical realms. Freight forwarding as a stand- alone business will be virtually extinct, since digital interactions will have reduced the need for intermediaries to manage logistics services for multiple participants in the value chain. Across the industry, all winners will have fully digitised their customer interactions and operating systems and will be closely connected via data ecosystems.

A fully autonomous transport chain will extend from initial loading, stowage, and sailing all the way to unloading directly into autonomous trains and trucks and drone-enabled last- mile deliveries.

The needs of customers will diverge: some will expect their shippers to be fully integrated into their supply chains—and be willing to pay a premium for that—while others continue to demand sea freight at the lowest possible cost. Both sets of customers will expect transparency and reliability to be the norm, not the exception.

What therefore has to be done to move shipping and containerisation further into the digital age?

First, invest in digital, which is the main way to differentiate products, disintermediate value chains, improve customer service, raise productivity, and cut costs. The risk is that tech giants and would-be digital disruptors will move faster than incumbents and capture most of the value from customer relationships.

Second, think about consolidation: the industry’s natural end game may involve fewer, larger operators. The past few decades of explosive trade growth created an environment that could sustain many players. Now that growth has slowed, the industry must rationalise overcapacity. Although some companies and investors could be candidates to lead the next wave of consolidation, becoming a target may sometimes be better for shareholders than struggling to be the winner at any cost. McKinsey research shows that from 2000 to 2015, in a range of industries, the value from deals was nine percentage points higher for average target companies than for average acquirers.21

Third, integrate. Some next-generation innovations now on the drawing board require careful orchestration across the value chain. Carriers and terminal operators share a particularly rich agenda: bigger vessels paired with investments in infrastructure for terminals, complete transparency on ship arrivals and berthing (thanks to geospatial analytics), and larger containers. Integrated logistics providers could make today’s freight forwarders largely irrelevant by mastering the complexity and the customer interface.

Fourth, be bold. The shipping industry has been built on the vision of audacious leaders with the per- severance to sail through the storms. It now faces a wave of digital disruption. The ability to convey a sense of purpose for employees, to create optimism about the journey ahead, and to maintain a steady course will be the hallmarks of the leaders shaping the industry for the next.

McKinsey and Company’s 1967 predictions were on point, so their analysis of the next 50 years of evolvement cannot be ignored. These changes seem massive and unachievable at the moment, but that would have been the case 50 years ago as well, and the industry is unrecognisable from then. It is exciting to watch what the next years have in store, and the advances that can be made to make sure that shipping does truly come alive during the digital age.

To view the full report please go here, where you can download the full report at the bottom of the page.