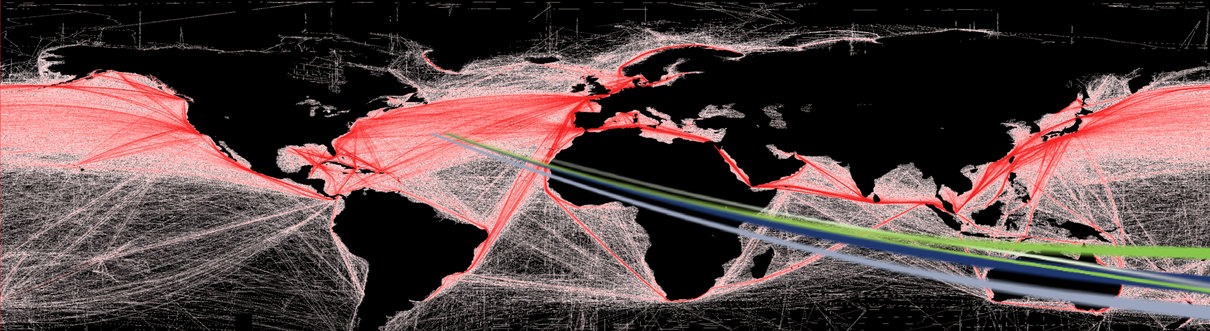

The Red Sea has long been a vital artery for global trade, connecting the Mediterranean Sea to the Indian Ocean and facilitating the movement of goods between Europe, Asia, and Africa. However, recent events involving Houthi rebel attacks in the region have sent shockwaves through the maritime industry, causing significant disruptions to ocean freight services…