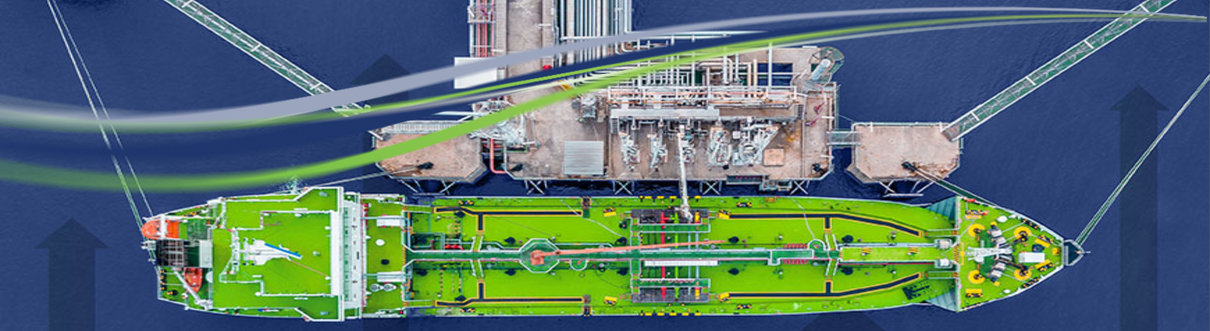

LNG is the most environmentally friendly, readily available fuel for shipping today – and in the foreseeable future, according to a new study. With the IMO’s 0.5% sulphur cap regulations coming into force next January, along with its target of halving C02 emissions from shipping by 2050, decisions need to be taken on alternative fuels.…