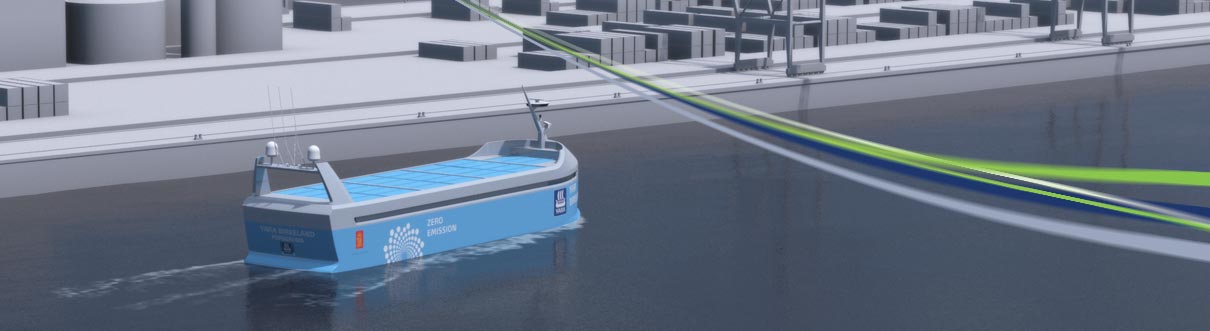

Built by Norwegian firms Kongsberg and Yara, the Yara Birkeland will be the world’s first fully electric autonomous container ship. It will use GPS, radar, cameras and sensors to navigate itself. With a cost of around £25 million, which is 3 times the cost of a standard container ship, she will hopefully pay for herself…