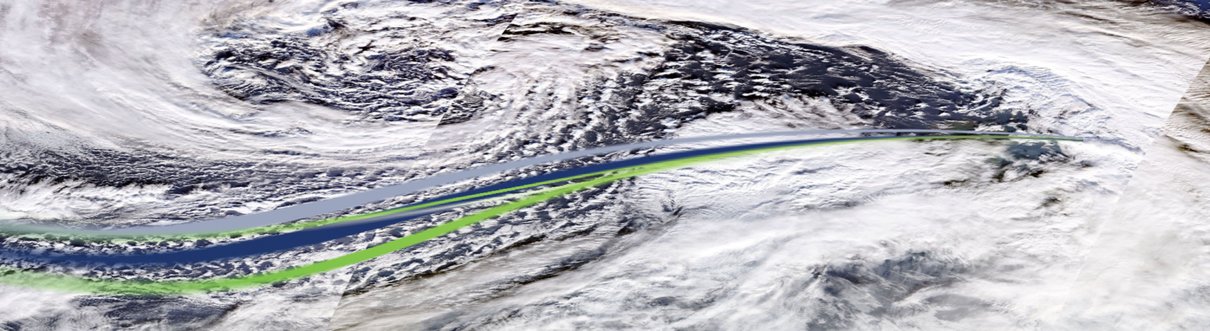

With the approach of the weather system known as the 'Beast from The East' heading to the UK over the next five days, the general consensus among Government agencies is that there will be significant delays and disruption to road networks across the UK. Although the initial impact will hit the East of the UK,…